IRS 941 2025 free printable template

Show details

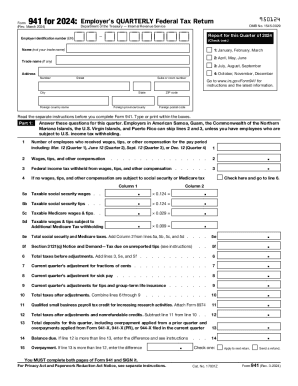

This form is used by employers to report income taxes, social security tax, or Medicare tax withheld from employee\'s paychecks, as well as the employer\'s portion of social security and Medicare

pdfFiller is not affiliated with IRS

Instructions and help about Form 941

How to edit the 941 Form with pdfFiller

How to fill out your Form 941 in 2025

Video tutorials for completing IRS tax forms

Instructions and help about Form 941

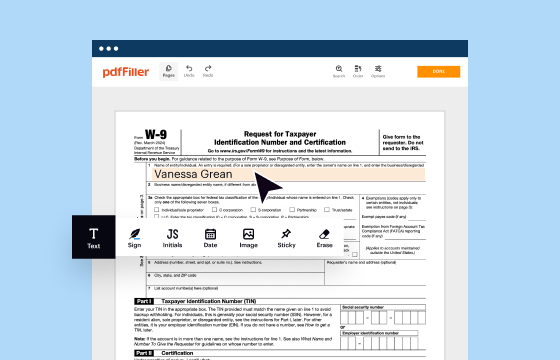

Employers use IRS Form 941 to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks and pay the employer's portion of Social Security or Medicare tax. Explore how quickly you can complete and edit your form electronically.

How to edit the 941 Form with pdfFiller

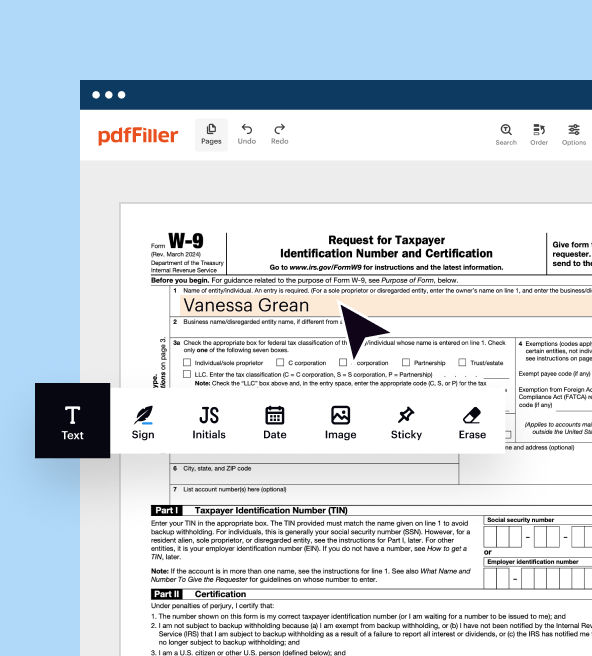

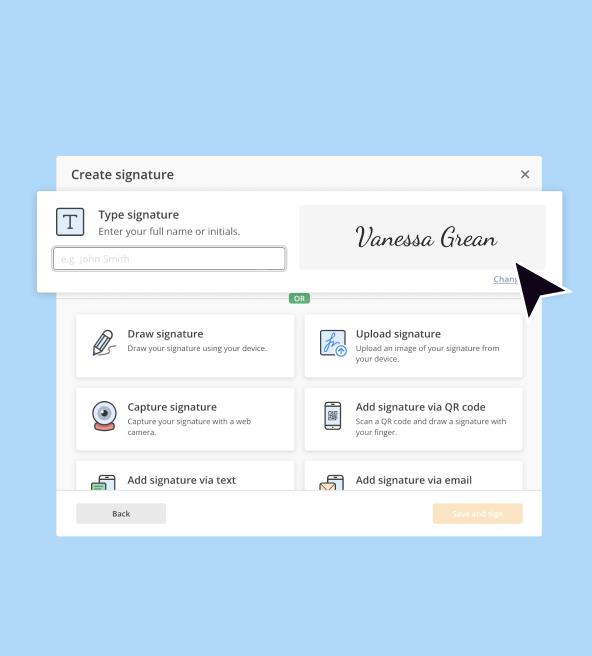

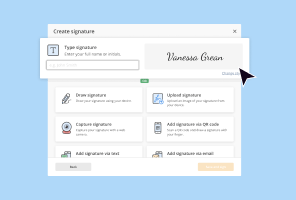

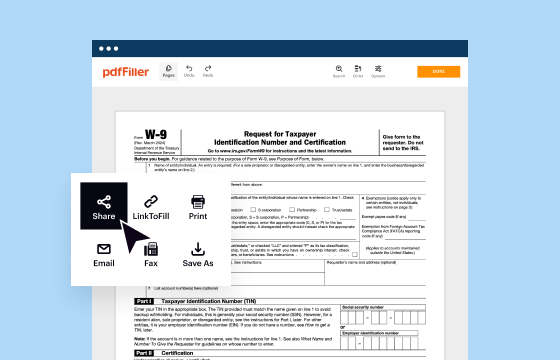

Easily edit Form 941 online with pdfFiller’s powerful online PDF editor. Follow these simple steps to manage your documents efficiently:

01

Sign in or create an account. Begin by accessing your pdfFiller account. New users can quickly sign up to unlock a complete suite of document editing tools.

02

Open your form. Click the "Get Form" button on the page to open your Form 941 in our dynamic online PDF editor.

03

Edit your document. Seamlessly change your form by rearranging or rotating pages, adding new text, or adjusting existing content. Leverage pdfFiller’s intuitive tools to customize your document to meet your needs.

04

Save changes. Once edits are complete, click DONE to save your changes.

05

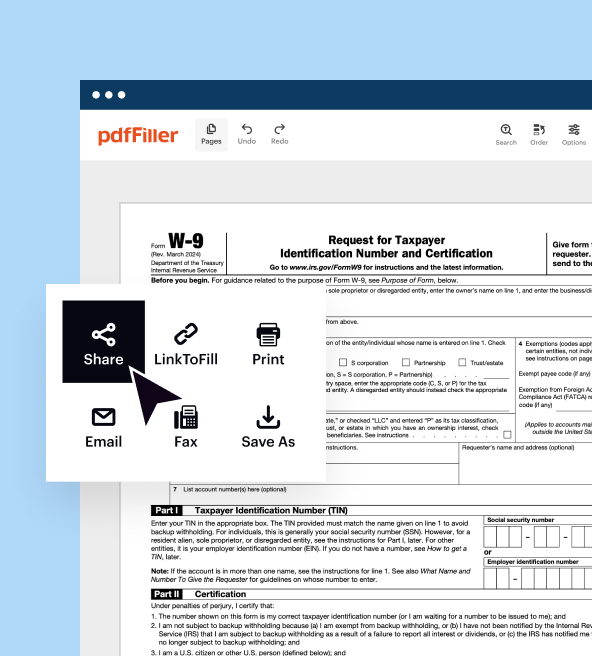

Share and store. Choose how to manage your updated Form 941. Options include downloading it as a PDF, emailing it, or saving it to the cloud for easy access and storage.

Editing Form 941 online is effortless with pdfFiller. Experience the convenience and efficiency of online document management today!

How to fill out your Form 941 in 2025

Navigating tax forms can seem daunting, but with a clear path, it becomes manageable. Here's a comprehensive guide to help you accurately fill out and file IRS Form 941.

Step 1: Prepare your information

Ensure you have your EIN ready. This unique nine-digit number is essential for tax filings. If you don't have one, apply online at IRS.gov/EIN or use Form SS-4. Use the business name and address as registered when you applied for your EIN.

Step 2: Enter your EIN, name, and address

On Form 941, type or print your EIN, business name, and address in the designated spaces. Remember to include your name and EIN on the top of page 2. Ensure the EIN and business name match IRS records exactly. Avoid using your SSN or ITIN.

Step 3: Quarter Selection

At the top of the federal 941 form, check the box corresponding to the quarter for which you're filing. Confirm it matches any attached schedules, such as Schedule B or Schedule R.

Step 4: Completing the form

Use a 10-point Courier font for entries, if possible. Do not use dollar signs or decimal points; commas are optional. Always enter cents, even if zero. Leave fields blank where the value is zero, except for lines 1, 2, and 12. Ensure negative amounts have a minus sign or are in parentheses. Complete both pages of Form 941 and sign on page 2.

Step 5: Notify Employees About Earned Income Credit (EIC)

Provide employees with Form W-2, a substitute Form W-2, Notice 797, or an equivalent written statement to inform them about the EIC.

Step 6: Reconcile with Form W-3

Ensure the amounts on your quarterly Forms 941 align with those on Form W-2 and the annual Form W-3. Discrepancies may lead to contact with the IRS or SSA.

Step 7: Filing Electronically

Consider Form 941 filing electronically for efficiency. For guidance, visit the official IRS web page about e-filing employment tax forms. You can also use tools like pdfFiller to complete the form electronically.

Step 8: Stay Updated

Notify the IRS immediately of any changes to your business name, address, or responsible party using Form 8822-B, not with the 941 tax form.

By methodically following these steps, you can confidently complete and file Form 941, ensuring compliance and accuracy. This proactive approach keeps your business in good standing and streamlines your tax filing process.

Video tutorials for completing IRS tax forms

Show more

Show less

Form 941: What's new for 2025?

Tax rates and limits

Expired COVID-19 credits

Increased research credit

Discontinuation of Forms 941-SS and 941-PR

Other features and reminders

Form 941: What's new for 2025?

Form 941 is the Employer's Quarterly Federal Tax Return form, which businesses use to report income taxes, Social Security, and Medicare taxes withheld from employees' paychecks, as well as the employer’s share of Social Security and Medicare taxes. Here are the key updates and features from the IRS instructions for the March 2024 revision:

Tax rates and limits

The Social Security tax rate remains 6.2% for employees and employers, with a wage base limit of $168,600. The Medicare tax rate is 1.45% each, with no wage base limit. These rates apply to household workers earning $2,700 or more and election workers earning $2,300 or more.

Expired COVID-19 credits

Credits for qualified sick and family leave wages related to COVID-19, applicable for leaves before October 1, 2021, are no longer claimable on Form 941. Employers who need to claim past credits must use Form 941-X.

Increased research credit

Under the Inflation Reduction Act, the maximum payroll tax credit for small businesses focusing on research has been increased from $250,000 to $500,000.

Discontinuation of Forms 941-SS and 941-PR

Form now replaces these 941 for employers in US territories, with Spanish versions available.

Other features and reminders

Form versions. Unless changes occur, use the March 2024 version for all quarters in 2024. Prior versions are accessible via IRS.gov.

Electronic payments and filings. Federal tax deposits must be conducted electronically. For easier transactions and compliance, businesses can use various electronic payment methods, including electronic funds withdrawal and credit/debit cards.

Certification for PEOs. Certified Professional Employer Organizations (CPEOs) must meet specific requirements and file Forms 941 and Schedule R electronically.

Compliance and penalties. To avoid penalties, employers must ensure accurate withholding, timely deposits, and precise submissions. If an error is found on a previously filed form, correction is done via Form 941-X.

Record of deposits. Businesses must determine if they are monthly or semiweekly depositors based on past tax liabilities to determine timely deposit schedules.

Form 941 is critical for ensuring compliance with federal tax obligations regarding team member pay and withholding. These updates emphasize the importance of using the correct forms, understanding available credits, and providing timely electronic filings and deposits. For detailed guidance, businesses should refer to IRS Publication 15 and related resources on the IRS website.

Show more

Show less

All you need about Form 941 2025

What is the federal 941 form in the US?

What is the purpose of the IRS 941 Form?

Who needs to file Form 941?

When am I exempt from filling out Form 941?

Components of the 941 tax form

What are the Form 941 due dates for 2024?

What information do I need to file 941 online?

Do other forms accompany IRS Form 941?

Where to send 941 Form?

All you need about Form 941 2025

As a business owner, it's essential to recognize the significance of accurately completing and submitting Form 941. Continue reading to discover answers to the most frequently asked questions about this important tax form.

What is the federal 941 form in the US?

Form 941, also known as the Employer's Quarterly Federal Tax Return, is a form businesses in the United States use to report employment taxes. This includes federal income tax withholding, Social Security and Medicare taxes, and additional taxes, such as Additional Medicare Tax or qualified sick leave wages for COVID-19.

What is the purpose of the IRS 941 Form?

The purpose of Form 941 is to report the federal income and employment taxes withheld from employees' paychecks, as well as the employer's portion of Social Security and Medicare taxes. The IRS uses this information to ensure that businesses properly withhold and pay their employees' taxes.

Who needs to file Form 941?

If you pay wages subject to federal income tax withholding and Social Security and Medicare taxes, you must file Form 941 quarterly. This form provides a comprehensive report of wages paid, employee-reported tips, withheld federal income tax, both employer and employee shares of Social Security and Medicare taxes, additional Medicare tax, adjustments for the current quarter, and any eligible small business payroll tax credits related to research activities.

When am I exempt from filling out Form 941?

There are several situations in which a business may be exempt from filing Form 941 for 2025. These include being a household employer, having no employees during the current quarter, or qualifying for an exception due to bankruptcy or seasonal employment. Additionally, if your business has not paid any wages that are subject to federal income tax withholding and Social Security and Medicare taxes for the entire quarter, you will not need to file Form 941. However, it is important to note that if your business becomes liable for these taxes at any point during the quarter, you must file Form 941 for that period. It is recommended that companies consult with a tax professional or refer to IRS guidelines to determine their exemption status and ensure compliance with tax laws.

Components of the 941 tax form

There are various components that make up Form 941 for 2024, including employee information, wages and taxes withheld, and tax liability. Let's take a closer look at each of these sections:

01

Employee Information: This section requires businesses to provide basic information about their employees, such as their names, social security numbers, and total hours worked during the quarter. This information is crucial for accurately reporting wages and taxes withheld.

02

Wages and Taxes Withheld: Here, businesses must report the total amount of wages paid to employees during the quarter, as well as any federal income tax withholding and Social Security and Medicare taxes withheld from those wages. This data is used to calculate the total tax liability owed by the business.

03

Tax Liability: This section calculates the total amount of taxes the business owes for the quarter. This includes federal income tax, Social Security and Medicare taxes, and any other applicable local or state taxes. It is important for businesses to accurately report this information to avoid penalties and interest payments.

What are the Form 941 due dates for 2024?

Form 941 is a quarterly report with deadlines typically on the last day of the month following the quarter's end. If all taxes are deposited on time, you get an extra ten days to file. You can file on the next business day if the due date falls on a weekend or holiday. For legal holidays, refer to Publication 15, Circular E (Section 11, Depositing Taxes – Deposits Due on Business Days Only).

What information do I need to file 941 online?

When filing Form 941, you must provide your business name, EIN (Employer Identification Number), address, and contact information. You will also need to report the total number of employees, their wages and tips, federal income tax withheld, and any adjustments for sick pay or tips. It is essential to prepare and keep all the information at hand to accurately report it and avoid penalties from the IRS.

Do other forms accompany IRS Form 941?

Depending on the business's specific circumstances, IRS Form 941 is often accompanied by other forms. Some common forms may include:

Schedule B (Form 941). Employers must report their tax liability semiweekly. This form provides a detailed breakdown of the tax liability for each day of the quarter.

Form 941-V. This is a payment voucher used when making a payment with Form 941. It helps the IRS process the payment correctly.

Form 8974. This form determines the amount of the qualified small business payroll tax credit for increasing research activities.

Form 8453-EMP. This is used to authenticate an electronic filing of Form 941.

These additions help ensure that all necessary information is provided and that the employer's tax obligations are accurately reported and paid.

Where to send 941 Form?

It is recommended to file Form 941 electronically. When opting for e-filing your employment tax form, you have two choices: filing it yourself or having a tax representative file on your behalf. For more information, visit IRS.gov/EmploymentEfile.

When filing a paper return, the 941 mailing address depends on whether you submit a payment along with your Form 941. Please refer to Form 941 Instructions 2024 and check where to mail based on your location.

Show more

Show less

FAQ

Why is Form 941 important?

Employers use Form 941 to report the amount of employment taxes they owe to the IRS. This form helps ensure that businesses comply with their federal tax obligations regarding employee pay and withholding. It also provides valuable information for the IRS to monitor businesses' payroll tax compliance, detect errors or discrepancies, and enforce penalties if necessary.

Do I have to file 941 online if no wages were paid?

Most employers need to file a 941 tax form even if no wages were paid. However, there are a few exceptions, including employers of seasonal employees, household employees, or farm employees. Other IRS forms may also be required.

How do I get a copy of my IRS Form 941?

Employers can obtain a copy of their filed Form 941 by requesting a transcript from the IRS. This can be done online, over the phone, or by mail. Employers may also request a photocopy of their original form by filling out Form 4506 and mailing it to the IRS. Employers must keep copies of all their tax forms for at least three years if they need to refer back to them in the future.

What is the difference between forms 940 and 941?

The two IRS forms share some similarities but serve distinct purposes. Form 940 is submitted annually and only reports an employer's Federal Unemployment Tax Act (FUTA) taxes. In contrast, Form 941 is filed quarterly and provides details on federal income tax withholding and Federal Insurance Contributions Act (FICA) taxes.

What happens if I don't file my Form 941?

Failing to file Form 941 or filing it late can lead to penalties from the IRS. The penalty for not filing is generally 5% of the unpaid monthly tax amount, up to a maximum of 25%. Additionally, interest will accrue on the unpaid tax amount until it is fully paid. Therefore, employers must file Form 941 on time and accurately report all payroll taxes.

What if I made a mistake on my federal 941 Form?

If an employer realizes they have made a mistake on their filed Form 941, they should submit a corrected form as soon as possible. The IRS allows this by filing Form 941-X, also known as the 'Adjustment Request.' This form must be submitted within three years of the original filing date or two years after the tax was paid, whichever is later. Employers should also explain the error and how it was corrected to avoid future penalties.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself.

It's a good app, but I get another app which is no charge.

Love how easy this is to use and it allows me to fill out information that used to require a typewriter or redoing an entire document.

Fill out Form 941

Forms related to the 941 Form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.