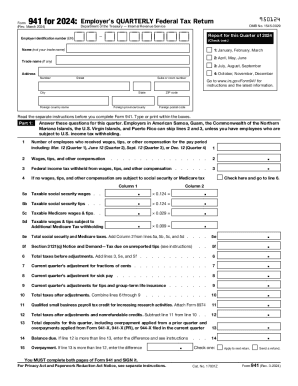

IRS 941 2025-2026 free printable template

Instructions and Help about IRS 941

How to edit IRS 941

How to fill out IRS 941

Latest updates to IRS 941

All You Need to Know About IRS 941

What is IRS 941?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 941

What should I do if I notice mistakes on my submitted IRS 941?

If you notice mistakes after filing the IRS 941, you need to file Form 941-X, the Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund. This form allows you to correct any errors. Be sure to follow the specific instructions provided for Form 941-X to ensure accurate filing and processing.

How can I confirm the IRS has received my IRS 941 submission?

To verify receipt of your submitted IRS 941 form, you can contact the IRS directly or use the 'Online Account' feature if you're a registered user. The IRS may provide confirmation messages or letters for e-filed submissions, helping you track processing status efficiently.

What should I keep in mind regarding the record retention period for IRS 941?

You should retain all records related to your IRS 941 filings, including supporting documentation, for at least four years from the date the tax becomes due or is paid. This ensures you have the necessary information in case of audits or inquiries from the IRS.

Are there special considerations for filing IRS 941 on behalf of someone else?

If you are filing IRS 941 on behalf of someone else, you will need to have the appropriate Power of Attorney (POA) documents. Ensure that you adhere to IRS guidelines regarding submission, such as including the name and taxpayer identification number for the individual or entity you're representing.

What steps should I take if I receive a notice from the IRS regarding my IRS 941?

If you receive a notice from the IRS about your IRS 941, first read it carefully to understand the issue. Respond to the notice promptly and provide any required documentation. Keeping a copy of your response and any correspondence with the IRS is crucial for your records.

See what our users say